45+ which is true of an adjustable rate mortgage

This type of mortgage is characterized by which the interest rate that will be paid will differ based on a particular benchmark. Web 102644-102645 Reserved Subpart F - Special Rules for Private Education Loans 102646 102648 Show Hide 102646 Special disclosure requirements for private education loans.

Umpqua 2021 Esg Report

Web An adjustable-rate mortgage is a type of loan that carries an interest rate that is constant at first but changes over time.

. Web The average rate on a 30-year jumbo mortgage is 682 and the average rate on a 51 ARM is 545. Web An adjustable-rate mortgage or ARM is a home loan with an interest rate that can change periodically. Web Usually its about 1 lower than a conventional mortgage rate.

Web Mortgage points or discount points are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment. The initial interest rate is usually lower than that of fixed-rate mortgages. Decide whether an ARM is the right loan.

Web 2 days agoAnnual Percentage Rate APR Apply online for personalized rates. No origination or application fees and no payments for up to 45. This adjustable-rate mortgage calculator helps you to approximate your possible adjustable mortgage.

The Six-Month Treasury Bill yes a true Treasury Bill the Eleventh District Cost of Funds COFI a Federal Cost of Funds. Keep in mind though that mortgage. Web If you were to opt for a 30-year fixed-rate mortgage the average rate is 578.

This is typically 45 days before the change date but could be more or fewer. On a 400000 mortgage loan the adjustable-rate option would save you 355 per month or 21300 over five years. Web An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan.

Fixed-rate and adjustable-rate mortgages included Types of loans Conventional loan FHA loan Jumbo loan and. They could go up sometimes by a loteven if interest rates dont go up. With a fixed-rate loan youll pay one set amount every month for the duration of your loan term like 15 20 or 30 years.

Web With an Adjustable Rate Mortgage your loans interest rate and therefore your mortgage payment will change every so often. Web Down the line your mortgage could adjust to a lower rate. An adjustable-rate mortgage ARM is a loan where the interest rate is fixed for a specific amount of time then adjusts periodically.

Understand the risks of different types of ARMs. One mortgage point is equal to about 1 of your total loan amount so on a 250000 loan one point would cost you about 2500. Your monthly payments could change.

In mid-April 2022 the average interest rate was 537 for a conventional loan while adjustable mortgage rates were around 43. Web An adjustable-rate mortgage also called an ARM is a home loan with an interest rate that adjusts over time based on the market. Web The interest rate on a 30-year fixed-rate mortgage began last year at around 326 and by the time December arrived rates had reached a steep 647.

Web Adjustable-rate mortgage defined. Web An adjustable-rate mortgage ARM is a loan with an interest rate that changes. The first interest rate is usually fixed for a period of time and then change after regularly monthly or.

Then the honeymoons over. That low rate stays locked in during the introductory periodanywhere from one to 10 years. Web How Does an Adjustable-rate Mortgage Work.

Web Adjustable-rate mortgages can provide attractive interest rates but your payment is not fixed. Understand an ARM versus a fixed-rate mortgage. Once the fixed-rate period ends an ARMs interest rate will adjust depending on the index it uses.

With home ownership being such a pricey. If you keep the same. ARMS are also called variable rate or.

Web An adjustable rate mortgage is also popularly known as the valuable rate mortgage or the floating rate mortgage. ARMs may start with lower monthly payments than fi xed-rate mortgages but keep in mind the following. The creditor assignee or servicer of an adjustable-rate mortgage shall provide consumers with disclosures as described in this paragraph c in.

Generally the initial interest. Web This booklet helps you understand important loan documents your lender gives you when you apply for an adjustable-rate mortgage ARM. When rates go up ARM borrowers.

Compare Current Mortgage Rates Mortgage Rates for February 15 2023. Web An adjustable-rate mortgage is a home loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark. This means that the monthly payments can go up or down.

Your lender should also give you a copy of this booklet which will help you. Borrowers also can refinance their mortgage if they notice market conditions are favorable. ARMs typically start with a lower interest rate than fixed-rate mortgages so an ARM is a great option if your goal is to get the lowest possible mortgage rate starting out.

Adjustable Rate Vs Fixed Rate Mortgage Calculator

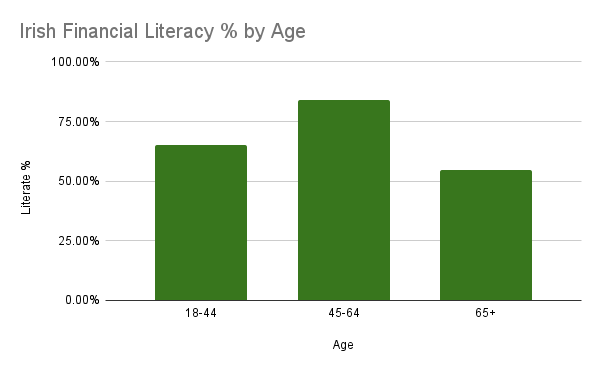

Irish Women Lead In Financial Literacy New Irish Money Guide Survey Shows Moneysherpa

Ask Maureen Antoinette Should I Wait To Buy Sdnews Com

Arm Mortgage Calculator Adjustable Rate Mortgage

More Inverted Home Loan Rate Offers Interest Co Nz

Myths About Adjustable Rate Mortgages

Explaining The Declined Affordability Of Housing For Low Income Private Renters Across Western Europe Caroline Dewilde 2018

An Adjustable Rate Mortgage Is The Best Type Of Mortgage To Get

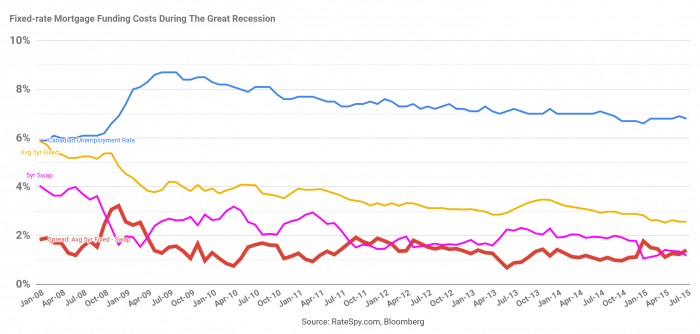

A Bridge To Lower Rates Ratespy Com

Reforms Incentives And Flexibilization Five Essays On Retirement

What Is An Adjustable Rate Mortgage And Will It Work For You

Mortgage Acceleration On An Arm Freeandclear

Abraham Estrada Relationship Banker Regions Bank Linkedin

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

How High Can An Adjustable Rate Mortgage Increase There S A Cap

Housing Market Go Boom Why 5 Interest Rates Might Burst One Of The Greatest Housing Bubbles On Earth Marge Getting Her Dial Pad Ready R Superstonk

Rbnz Governor And Big 4 Bank Bosses Tee Off In Negative Interest Rate Scrap Interest Co Nz